This blog post was originally posted on LinkedIn. Please visit the post there to engage with comments.

As the fintech industry continues to revolutionize traditional banking, the emergence of Neo Banks has been met with both excitement and skepticism. These digital-first institutions promise convenience, innovation, and flexibility, yet navigating the landscape of Neo Banks reveals countless challenges that demand attention and resolution. Summetix examined the challenges faced by German Neo Banks over the past six months and tracked changes in customer perceptions. By using the Apple App Store and Google Play Store reviews, we analyzed four leading Neo Banks. Of course, we have anonymized the banks using pseudonyms.

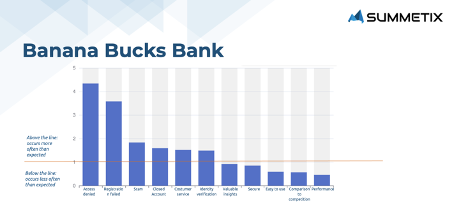

🍌💳 Banana Bucks Bank: Access Woes and Registration Woes

Banana Bucks Bank, hailed for its sleek interface and user-friendly design, has encountered its fair share of hurdles according to user reviews. Denial of access to accounts and reported registration issues have surfaced as persistent concerns. Despite its reputation for performance and ease of use, recent months have seen a decline in positive feedback in these aspects, signaling potential operational challenges that must be addressed.

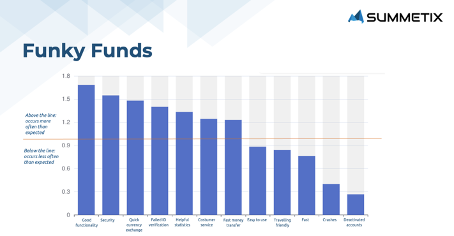

🎉💰Funky Funds: Security Amidst Functionalities

Funky Funds, which customers appreciate for its extensive functionalities and robust security features, faces its own set of obstacles. Failed ID registrations have become increasingly prevalent and instances of app crashes and deactivated accounts, though less frequent, are also impacting customer satisfaction.

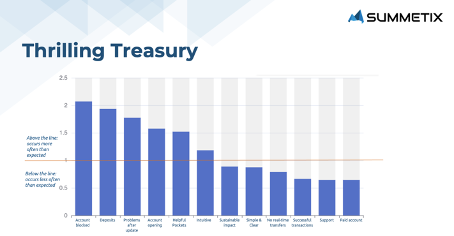

🌱🎁 Thrilling Treasury: Transaction Alerts and Access Hurdles

Thrilling Treasury stands out for its emphasis on sustainability and ethical banking practices. However, users have voiced concerns over blocked accounts and access issues, overshadowing positive mentions of transaction notifications and the pocket function. The decline in reported paid accounts suggests a shift in user preferences or dissatisfaction with premium offerings.

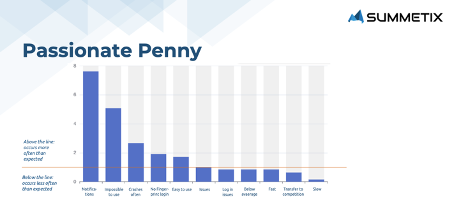

💖💰Passionate Penny: Notifications and App Functionality

Passionate Penny, a traditional bank venturing into the digital realm, faces challenges in app functionality and user experience. While transaction notifications garner praise, frequent crashes post-update and restrictions on app usage dampen the overall user experience. Despite these setbacks, a decrease in the urgency to switch banks indicates a degree of loyalty among customers.

🔍 Comparison Insights: The Common Threads

Across Neo Banks, certain challenges emerge as common threads. Fast transactions are lauded, but connectivity issues plague users, particularly in recent months. Advertising takes a backseat as users prioritize practicality and intuitive banking experiences. While positive aspects receive recognition, concerns linger regarding account access, app functionality, and account switching difficulties.

🎯🚀Conclusion: Addressing Challenges, Embracing Innovation

The journey of Neo Banks is not without its obstacles. From access issues to app functionality concerns, customer feedback serves as a compass guiding these institutions towards improvement and innovation. By heeding user concerns, Neo Banks can fortify their offerings, enhance customer experiences, and solidify their position in the ever-evolving fintech landscape.

What do you think about Neo Banks? Can you guess which insight fits to which bank?

Engage with us on LinkedIn!

#NeoBanks #Fintech #UserFeedback #Summetix #SummetixAnalysis